Planning for life’s unexpected moments might not be the most glamorous topic, but it’s one of the most important. Whether it’s an illness during a dream vacation or decisions about end-of-life care, preparation can mean the difference between unnecessary stress and peace of mind.

What Should You Know About Emergency Planning for Sickness and End of Life—Here’s How to Prepare

Here, we break down some practical steps you can take to plan for emergencies, sickness, and end-of-life situations, offering both peace of mind and clarity when it’s needed most.

What Happens if You Get Sick While Visiting Beaches?

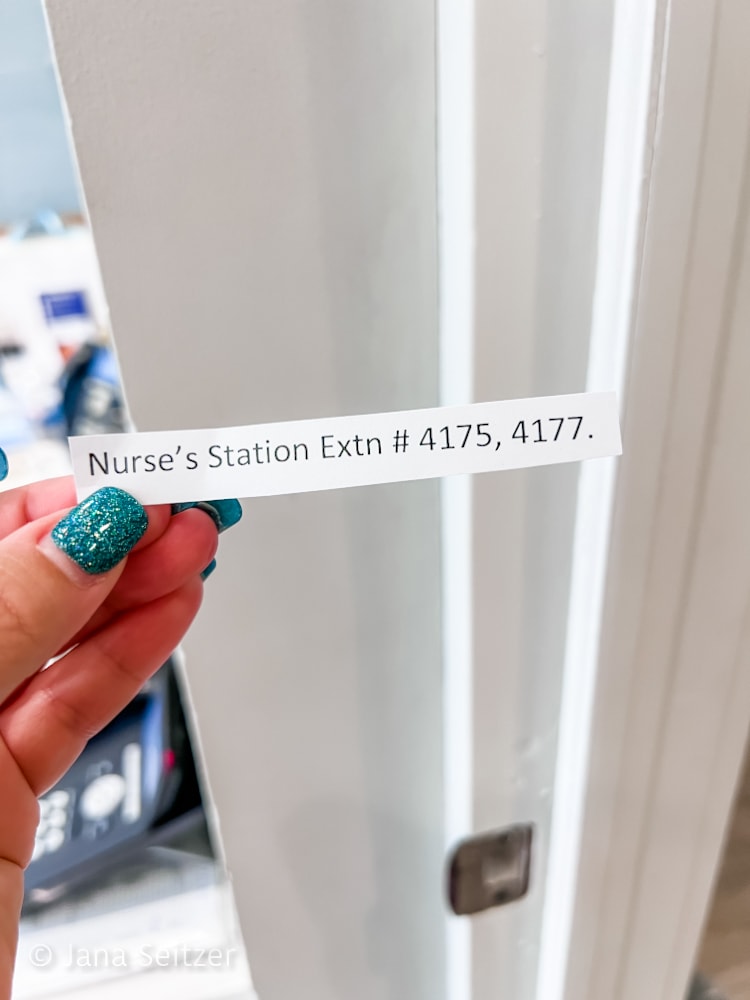

Picture this: you’re lounging on one of the gorgeous beaches in Turks and Caicos, drink in hand, toes in the sand when a sudden illness strikes. What do you do? While no one wants to think about getting sick on vacation, it’s a reality worth preparing for. Knowing the healthcare options at your destination (especially an international one) is a critical part of any travel plan.

For example, the resources available in Turks and Caicos are designed to ensure visitors can access medical care quickly and efficiently. Many resorts, including those on this tropical island, have medical professionals right there on staff or partnerships with local healthcare providers. Before you pack your bags, research what’s available, and make sure your travel insurance also covers potential medical emergencies. It’s always better to know how to handle the unexpected before it happens, especially in paradise.

Planning for Hospice Care is a Gift to Yourself and Your Loved Ones

When facing end-of-life decisions, hospice care can provide unparalleled support for both patients and their families. It’s not about giving up—it’s about focusing on someone’s comfort, dignity, and overall quality of life. Choosing hospice care in advance ensures your wishes are honored and gives your family a clear plan to follow, reducing confusion and stress.

Services like those you find at Ohio, Nebraska, and Arizona hospice care centers offer holistic, compassionate assistance tailored to individual needs. From managing pain to providing emotional and spiritual support, hospice professionals help families focus on what matters most: spending meaningful time together. Discussing your preferences now—where you’d like to receive care, which type of support you’d prefer—ensures that you have control over this important chapter. It’s not an easy conversation, but it’s a profoundly important one.

Life Insurance to Protect Your Family

Life insurance is one of those things you don’t think you need until it’s too late, but it’s an essential part of emergency planning. Everyone should have even a small plan, even if it’s only enough to cover funeral costs. A well-chosen policy can cover everything from final expenses to replacing lost income for your loved ones. It’s not just about the money—it’s about giving your family stability and making things easier for them during a tumultuous time.

When considering life insurance, think about your family’s unique needs. Do you have young children? A mortgage? Loved ones who depend on your income? Tailoring your policy to meet these specific requirements can provide a safety net that helps your family focus on healing rather than financial stress.

You Should Have a Will (Yes, Even If You’re Young)

A will isn’t just for the wealthy or the elderly—it’s for anyone who wants a say in what happens after they’re gone. As a parent of four, I’ve had a will since my youngest was born. Without a will in place, your assets, belongings, and even guardianship decisions for your children could be left up to the courts. A will gives you control, ensuring that your wishes are respected.

Creating a will doesn’t have to be complicated. An easy start is to simply write down your assets and think about how you’d like them distributed. If you have children, consider who you’d want to take care of them in your absence. Once you’ve outlined your wishes, work with an attorney to formalize the document. This one simple step can save your loved ones a lot of heartache and confusion.

Travel Insurance Is Non-Negotiable for Adventurers

Travel insurance might feel like an unnecessary extra expense, but it’s a small price to pay for peace of mind if you travel often. From medical emergencies to trip cancellations, the right policy can cover a range of unexpected situations. Think of it as a safety net that ensures your dream vacation doesn’t turn into a financial nightmare. Email me for a quote!

When shopping for travel insurance, make sure to read the fine print. Does it cover medical evacuation? What about pre-existing conditions? Travel insurance policies vary widely, so it’s important to choose one that meets your specific needs. And remember: travel insurance isn’t just for international trips. Even domestic travel can come with its own set of risks, making travel insurance an essential part of your emergency plan and every day travel needs.

- What Should You Know About Emergency Planning for Sickness - January 26, 2025

- Is NYC Still the Capital of Cool - January 7, 2025

- DIY Star Trek Prodigy Combadge Vinyl Sticker - December 17, 2024

Leave a Reply